Space 4 Critical Infrastructure – Banking & Financial Markets

After the summer break, NEREUS and Eurisy continue their series on Space 4 Critical Infrastructure. The webinars focus on ten sectors identified in the proposed EU Directive on the resilience of critical entities. The million-dollar question this time is: how can space support the financial and insurance sectors?

Green finance

Claire Jolly, Head of Innovation Policies for Space and Oceans Unit at the Organisation for Economic Co-operation and Development (OECD), focused on green finance and investments to better manage environmental and social risks. When taking on investments for infrastructure works, investors want to be sure that their investment decisions are indeed green and sustainable. The Environmental Social Governance (ESG) criteria are a way to do exactly that. They are a set of standards for operations that investors use to assess sustainability. According to this report of the UNDP Financial Centres for Sustainability, the market for ESG criteria has tripled in just five years.

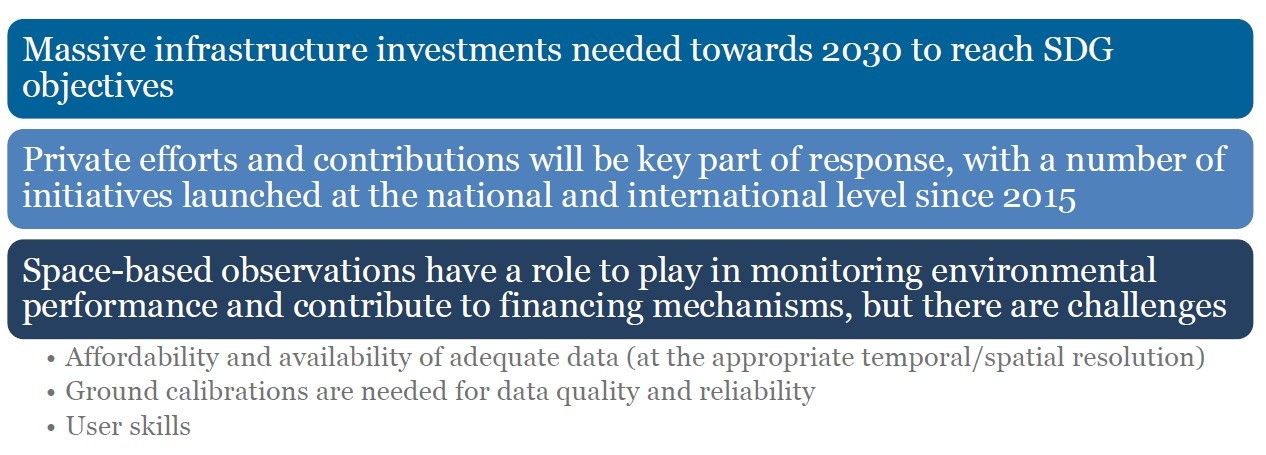

Assessing ESG criteria requires the availability of accurate data. Space can meet the high demand for indicators at all levels, from public institutions and the corporate world. Especially for environmental parameters such as carbon emissions, there are opportunities to use satellite data to help monitor pollution and changes in land use. Particularly in large scale projects involving deforestation and urban developments, satellite-based observations already contribute to the monitoring of environmental indicators such as air quality and land cover to guide investment decisions.

Financial assessments from space

Sascha Deutsch, Business Analyst at the ESA Commercialisation Gateway elaborated on the role of space in ESG. Space has the highest added value in the environmental part and can be a solution to the information asymmetry between investors and corporates. The main source of company-level ESG data is still voluntary disclosure. This might cause issues about accuracy coverage and granularity. There is a need for more objective science-based data. A combination of machine learning and space-based infrastructure can provide better insights for the monitoring and evaluation of environmental footprints looking at air pollution, water pollution, landscape change, biodiversity, etc. Today, publicly accessible satellite data merged with private constellations can provide inexpensive environmental data in high resolution. In contrast to ground measurements, Earth observation data can map and monitor changes in a scalable and economic way.

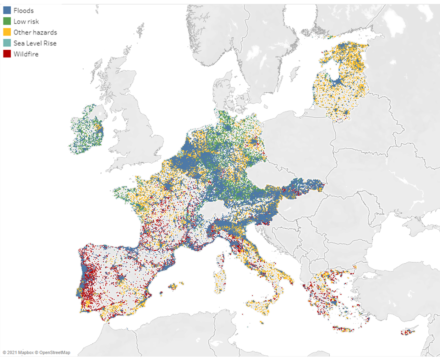

Apart from monitoring the impact on the environment, space assets can also help to actively protect the environment and to reduce climate risks. This can be the case on asset level for example boosting the resilience of a power plant, but also for banks and other financial institutions testing the financial stability on national levels, for example calculating the economic dependency of agriculture and the related climate risks. The European Central Bank also undertakes financial or climate-related stress testing across the euro zone. To assess the risks coming from natural hazards, climate data and scenarios are matched with asset-level data to quantify Earth observation into measurable numbers which can be used by the financial sector.

The EU space programme

Finally, EUSPA, the European Union Agency for the Space Programme that manages flagship space programmes like EGNOS, Galileo, GovSatCom, and Copernicus, is also looking at the financial world. With the objective to increase the commercial use of space data, the agency works around different market segments as outlined in the EUSPA Market Report. Valeria Catalano, Market Development Officer at EUSPA, presented an overview of what the EU Space programme can do for the finance and insurance markets.

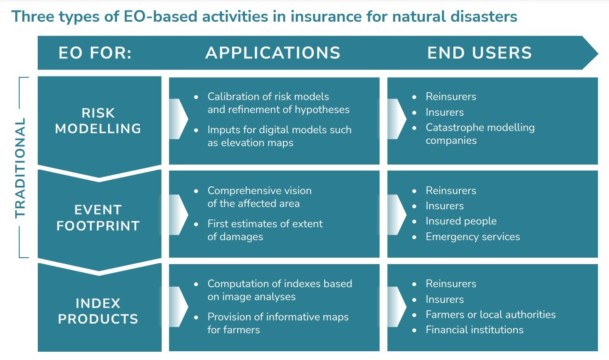

Combined with other digital technologies like artificial intelligence, Earth observation can provide insights to support loan decision-making by feeding credit risk assessment models and forecasting events likely to have an impact on reimbursement, while limiting the need for on-site inspections. In the domain of agriculture for instance, Earth observation can provide historical information on farm performance, estimate crop production thanks to vegetation, soil and water-related data, and help to monitor the progress of farming activities. Within the insurance market, Earth observation can be used for assessing damage and claim management (event footprint), calibration of risk models (risk modelling), and to compute indices for parametric products particularly for crops and livestock insurance (index production).

EUSPA Market Report 2022

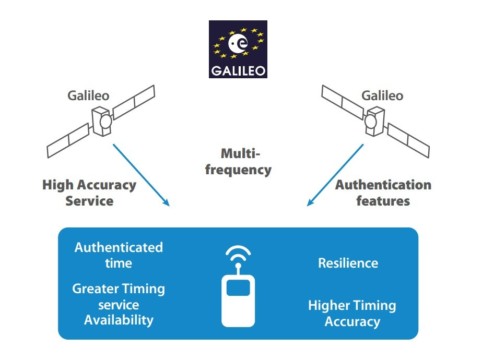

Satellite navigation applications have also found their way in the financial market. A new area of GNSS usage is linked to improving security transaction and fraud detection leveraging on mobile-enabled positioning as a security mechanism. Using mobile GNSS data as an added layer of security allows banks or service providers to use the geolocation information gained from mobile apps to determine whether a transaction aligns with the location of the customer’s mobile, giving them another way to detect that a fraudulent transaction is underway. Several banks and fintech payment providers have already incorporated location-based authentication using mobile phones’ GNSS data.

EUSPA Market Report 2022

Market barriers

In the pursuit for more objective data, satellites offer a way to monitor environmental indicators. Nevertheless, there are still some barriers hindering the uptake of space data. In the first place, dissemination remains important to show the value of space data in the financial and insurance markets. Equally important is to ensure that the data is easy to use by the intermediaries, such as analytics companies building up the products on top of the satellite imagery. Practical training is needed on access to data, privacy regulations, and digital infrastructure. When it comes to financial forecasts, there is a gap in the climate data coverage for emerging markets in Africa and for certain types of risks, as well as a lack of forward-looking data. Other obstacles are the need for a higher degree of granularity and data accessibility. For the time being, data collection is still very much a manual process in the hands of financial institutions.

Would you like to do more on space and finance? Then do not hesitate to register for the Cassini Hackathons “Space for the Financial World” in November. Find our case on Improving Financial Estimates and Forecasts which might help you out with your ideation!

Don’t forget to register for our next Space 4 Critical Infrastructure webinar on the 27th of October, this with a focus on transport and energy.

Watch the full recordings here.